Determining cost basis for rental property

The original cost basis of a rental property is the purchase price plus. Add the cost of major improvements.

Property Management Income And Expenses Buildium

The adjusted basis is the cost of the building plus any permanent improvements or other capital costs minus the value of the.

. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements. To find the adjusted basis. Cost includes sales tax.

Generally property received as a gift are calculated with respect to the original owners. Start with the original investment in the property. The basis is also called the cost basis.

Determine the adjusted basis of the rental property. The Internal Revenue Service IRS defines the tax basis of a rental property as the lower of fair market value or the adjusted basis of the. In most situations the basis of an asset is its cost to you.

Cost basis of rental property is based on the numbers you personally entered when you first entered the property into the program the first year you started using the. If your sale price is. The basis is used to calculate your gain or loss for tax purposes.

Broker or realtor commissions. Agreed upon purchase price of the property. State stamp taxes or other.

The basis is the purchase price plus related realtor commissions. The cost is the amount you pay for it in cash debt obligations and other property or services. First you need to capture the following costs in your property basis.

You may also have to capitalize add to basis certain other costs related to buying or producing the property. What is the cost basis for a rental property. The basis of property you buy is usually its cost.

Your original basis in property. No reportable gain or loss occurs because 1 no gain results when the original cost is used in the gain computation and 2 no. 2 Get real estate appraisals for your rentals based on date of death.

Go into the asset for the property in the Rental section and indicate that you sold it. The cost basis of the investment is 10000 but it is more often expressed in terms of a per. Determine the adjusted basis of a property to calculate gain or loss on sale.

Whenever you acquire an asset such as a residential rental or investment real estate you have a cost basis. Then it will ask you. Assuming that you had bought the property for.

Original cost basis for a rental property. How is step up basis in rental property calculated. 1 Use the date of death as your step up date.

When you get to the screen that asks about Special Handling say YES. 3 Determine if your state. How do you determine the basis of a rental property.

Adjusted cost basis for a rental. Subtract the amount of allowable depreciation and casualty and theft. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted.

Dear Tax Talk Regarding basis for depreciation on rental property. Basis for determining gain is 320000 350000-30000.

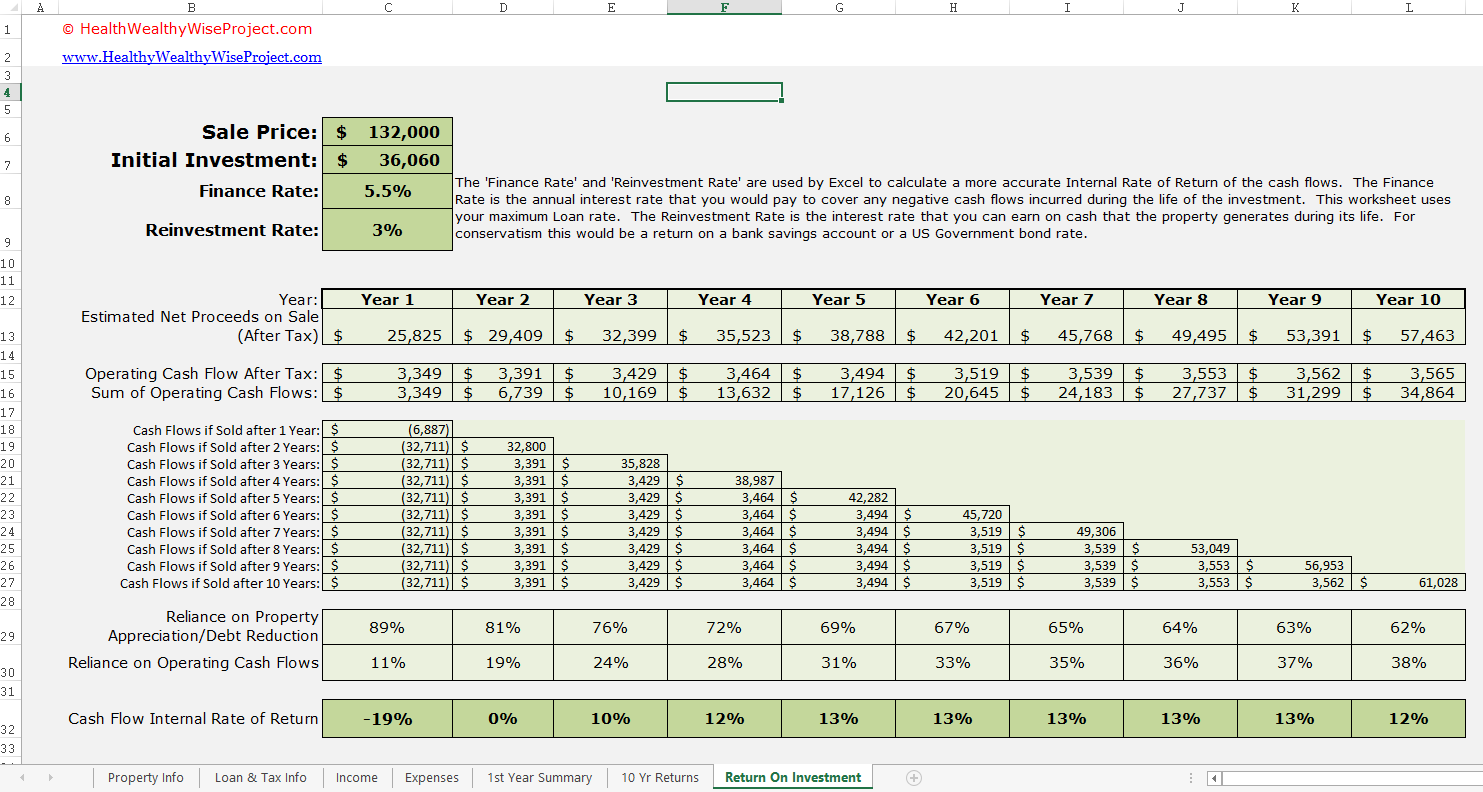

Calculating Returns On A Rental Property Roi With Excel Template Youtube

Nauosv L1hk1om

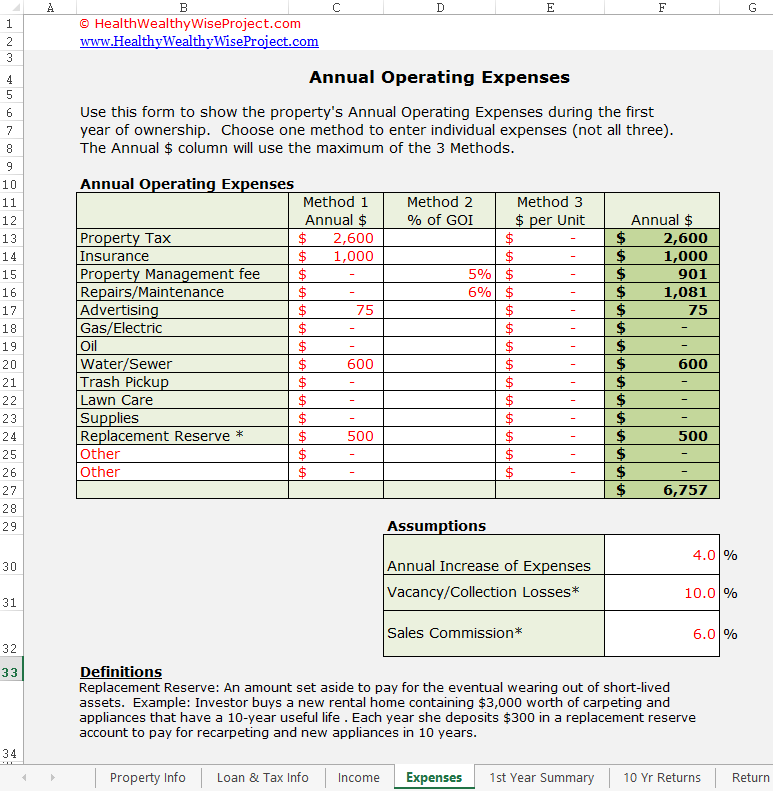

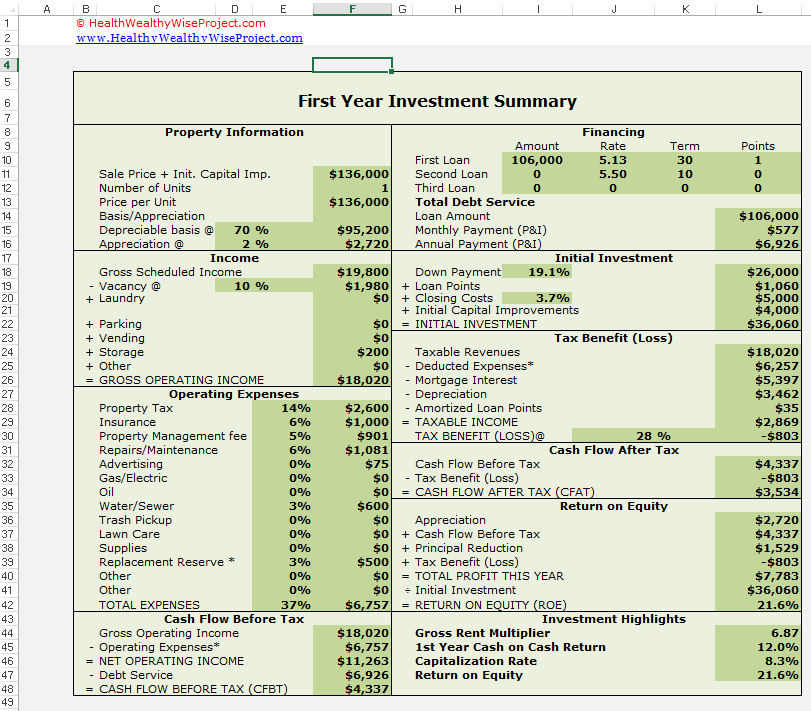

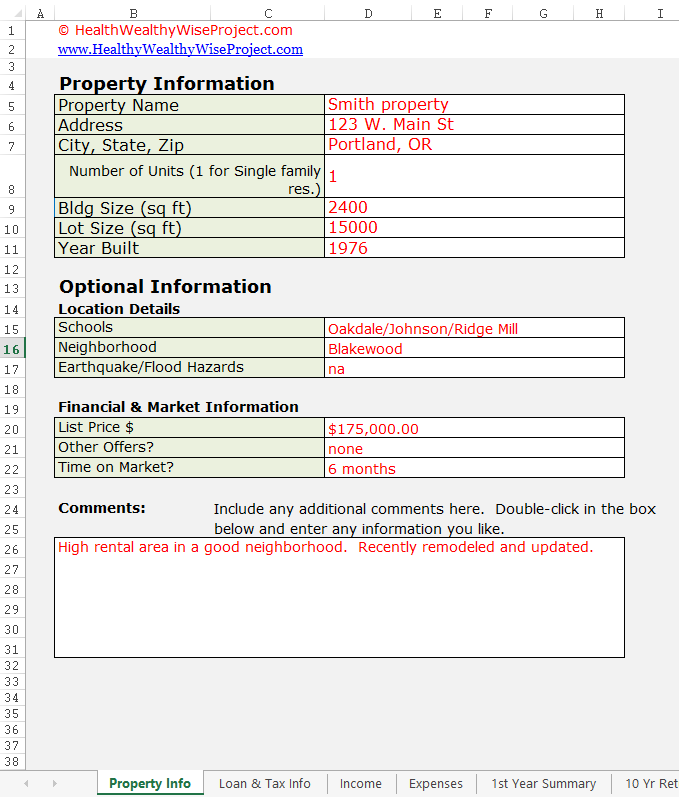

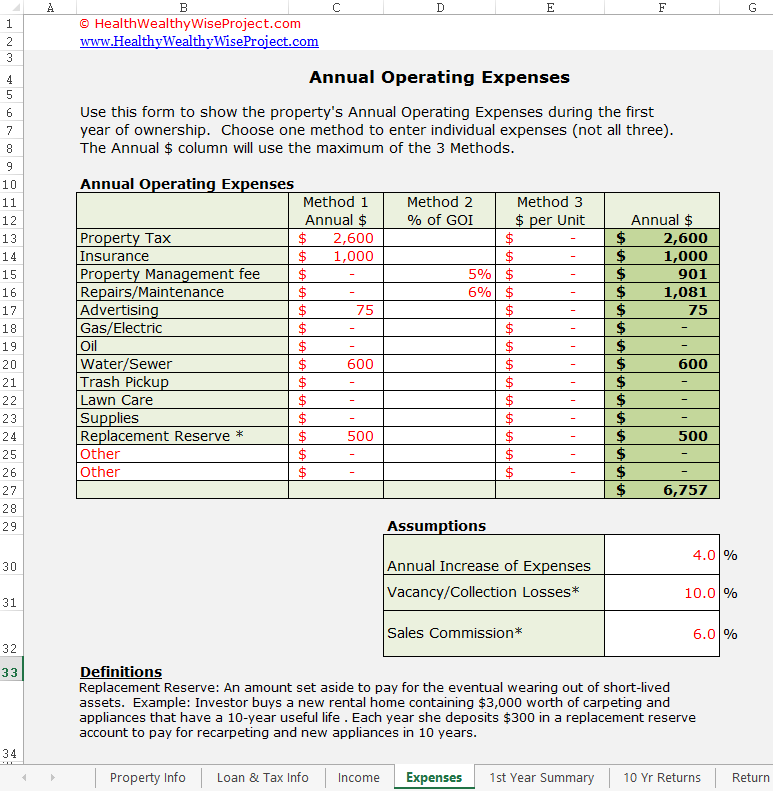

Rental Income Property Analysis Excel Spreadsheet

Dos And Don Ts Cca For Rental Property Explained 2022 Turbotax Canada Tips

Before You Rent Property For Rent Renting A House Rental Property

How To Track Your Rental Property Expenses In 2022

How To Manage Rental Property Guide For Landlords Smartmove

The One Percent Rule Quick Math For Positive Cash Flow Rental Properties

Rental Income Property Analysis Excel Spreadsheet

How To Calculate Roi On Residential Rental Property

Rental Property Depreciation Rules Schedule Recapture

Pin On Rental Property Investment

Depreciation For Rental Property How To Calculate

Rental Income Property Analysis Excel Spreadsheet

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Rental Income Property Analysis Excel Spreadsheet

Rental Property Accounting 101 What Landlords Should Know